Florian Lampe von der Uni Hamburg und Anne Löscher haben in den ZÖSS–Discussion Papers ihr Arbeitspapier A post-Keynesian perspective on the eco zone project. Liquidity premia and external financial fragility in the West African Economic and Monetary Union, Ghana and Nigeria veröffentlicht. Darin gehen sie der Frage nach, was – sollte es realisiert werden – das Währungsunionsprojekt in Westafrika für die Liquiditätsprämien der beteiligten Währungen bedeuten würde. Das Paper kann hier ohne Paywall abgerufen werden.

Abstract:

The paper treats the eco currency union project in West Africa and its implications for

monetary policies against the backdrop of the international monetary order from a post–

Keynesian perspective. The eco zone project envisions a common monetary union of the

West African Economic and Monetary Union (WAEMU), i.e. the independent Western

subzone of the CFA franc union, and the remaining non–CFA countries of the Economic

Community of West African States (ECOWAS) with Nigeria and Ghana as the economically

most important member states. The literature on the international currency hierarchy

developed by Latin–American structuralists and the post–Keynesian Berlin School of thought

focuses on the notion of a currency–specific liquidity premium that structurally determines

the interest rate level in the corresponding currency areas. Based on this set of literature, we

conduct a comparison between the liquidity premia of the Western CFA–franc, the Nigerian

naira and the Ghanaian cedi to make conjectures about what implications a common

ECOWAS currency union would have regarding monetary policy space. Being a non–

pecuniary variable, the liquidity premium cannot be observed directly. We therefore

approximate the liquidity premium by calculating differences in interest rates such as the

central bank’s base rate, the coupon rate on T–bills and bonds and the interest rate spread

between Eurobonds and bonds denominated in local currency. Besides, we use balance of

payment data to identify external financial fragilities that might become a crucial factor for

monetary policy due to an increasing financialisation in West African economies.

We find that investors demand structurally higher yields on bonds originating in Ghana and

Nigeria than in the CFA–franc zone. One could interpret this as the CFA–franc conveying over

a higher liquidity premium because it has to have lower yields rates to compensate for

liquidity–differences to financial assets denominated in the US dollar or euro. However,

another explanation is that expectations about the future developments of the cedi’s and

naira’s exchange value by investors are more pessimistic in comparison to that of the CFA–

franc. This is rooted in two major factors: Firstly, under the current arrangement, France

still has leeway in monetary policy making and acts as exchange rate stabiliser by pushing

for restrictive monetary policies and guaranteeing foreign exchange reserve provision.

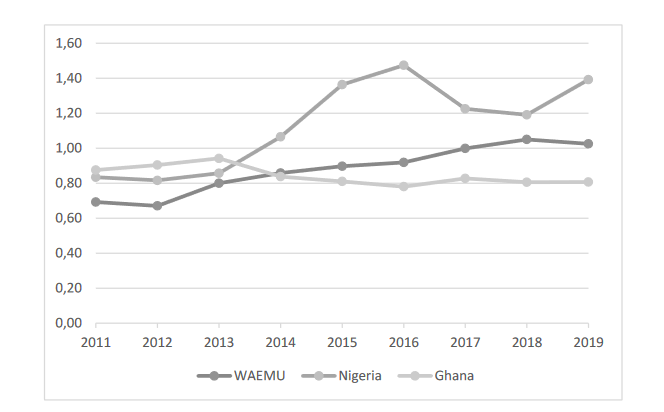

Secondly, the estimation of external financial fragility in the WAEMU, Nigeria and Ghana

shows that the naira implies a greater risk of sudden devaluation compared to the Western

CFA franc and the cedi due to Nigeria’s higher exposure to mobile liabilities vis–à–vis its

asset endowments.

Keywords: West African Economic and Monetary Union, CFA franc, eco zone, international

currency hierarchy, external financial fragility

JEL codes: E12, F33, F41, G11, O57